Georgia and the One Big Beautiful Bill Act

With the One Big Beautiful Bill Act (OBBB) finally passed as of July 4, 2025, many states are looking at big changes on the horizon. Georgia is expected to fare better than many states, but the full impact of OBBB remains uncertain. Governor Kemp recently called for a spending freeze in FY 2027 as well as contingency plans from state agencies. Rick Dunn, Director of Georgia’s Office of Planning and Budget, stated in a letter to state agency heads that his office believes that current revenue projections are sufficient to meet spending requirements but that agencies need to be prepared if conditions change.

The Final Form of the One Big Beautiful Bill

Throughout the process of passing OBBB, groups like KFF tracked provisions in the draft bill. While there was some fluctuation in the specific details, OBBB broadly retained a similar set of health-related provisions throughout the legislative process. The Congressional Budget Office estimates that the version of the bill signed into law will result in a net-increase to the United States’ budget deficit totaling to $3.4 trillion over the period from 2025-2034. This increase in the deficit reflects a decrease in spending of $1.1 trillion and a decrease in revenues of $4.5 trillion.

Spending decreases result from program changes in several areas of the budget, the most well publicized of which are alterations to the Supplemental Nutrition Assistance Program (SNAP) and to healthcare-related programs tied to Medicaid and the Affordable Care Act. There were also changes to student loan repayment programs.

OBBB also decreased tax revenue by extending and expanding tax cuts put into place in the 2017 Tax Cuts and Jobs Act. The bill includes an enhanced child tax credit, moving from $2,000 to $2,200 per child, and an enhanced standard deduction and estate tax exemption. The bill also includes temporary deductions on qualifying tip income and eligible overtime pay.

OBBB’s effect on individuals is largely contingent on household income. The Penn Wharton Budget Model estimates that households in the lowest income quintile lose about $885 in 2030, a result of net reductions in taxes and transfers, and the households in the top quintile will gain over $4,000, with the top 0.1% of earners expected to see an average gain in after tax income of $72,885, in the same year. Lower income households will be impacted by the cuts to Medicaid and SNAP; meanwhile, households’ gains in the highest income quintiles are due to the extended tax cuts.

ADA worked to support adjustments to certain provisions of OBBB. They advocated for a full restoration of the pass-through entity tax deduction following a set of proposed changes which would have led to an almost 5% tax increase on dental practices. ADA’s advocacy also targeted provisions related to student loans. The bill’s elimination of the GradPLUS program, a loan program granting graduate students access to additional federal funds, and new lifetime caps on financial aid amounts may have implications for the future dental workforce.

OBBB and Georgia

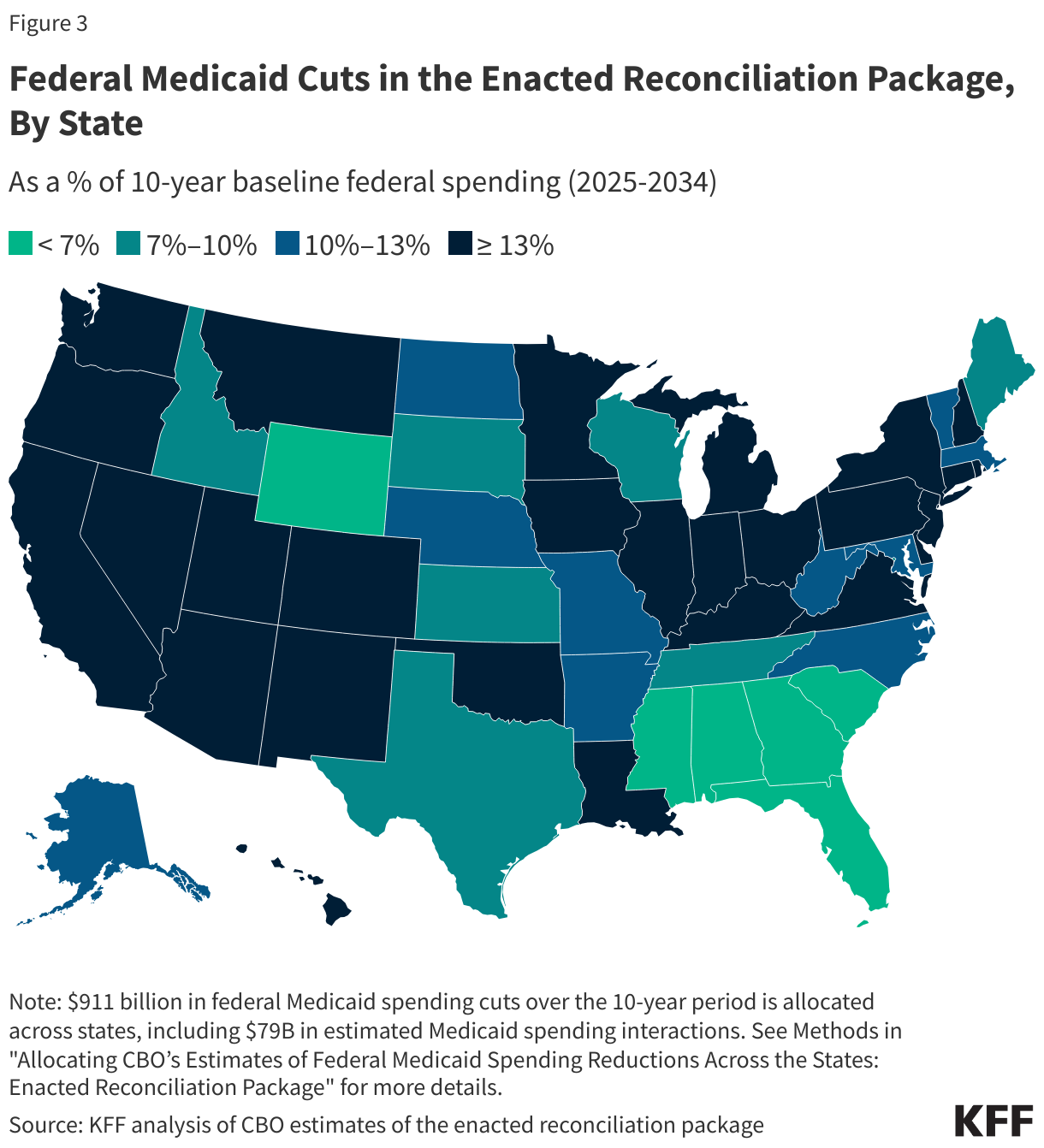

Of OBBB’s potential $1.1 trillion decrease in spending, KFF estimates that $6 billion to $10 billion can be allocated to Georgia, less than 1% of the total impact of OBBB. This represents about 6% of baseline federal spending. For the sake of comparison, $17 billion to $28 billion, 11% of baseline federal spending, can be allocated to North Carolina, a state with 180,000 fewer people than Georgia.

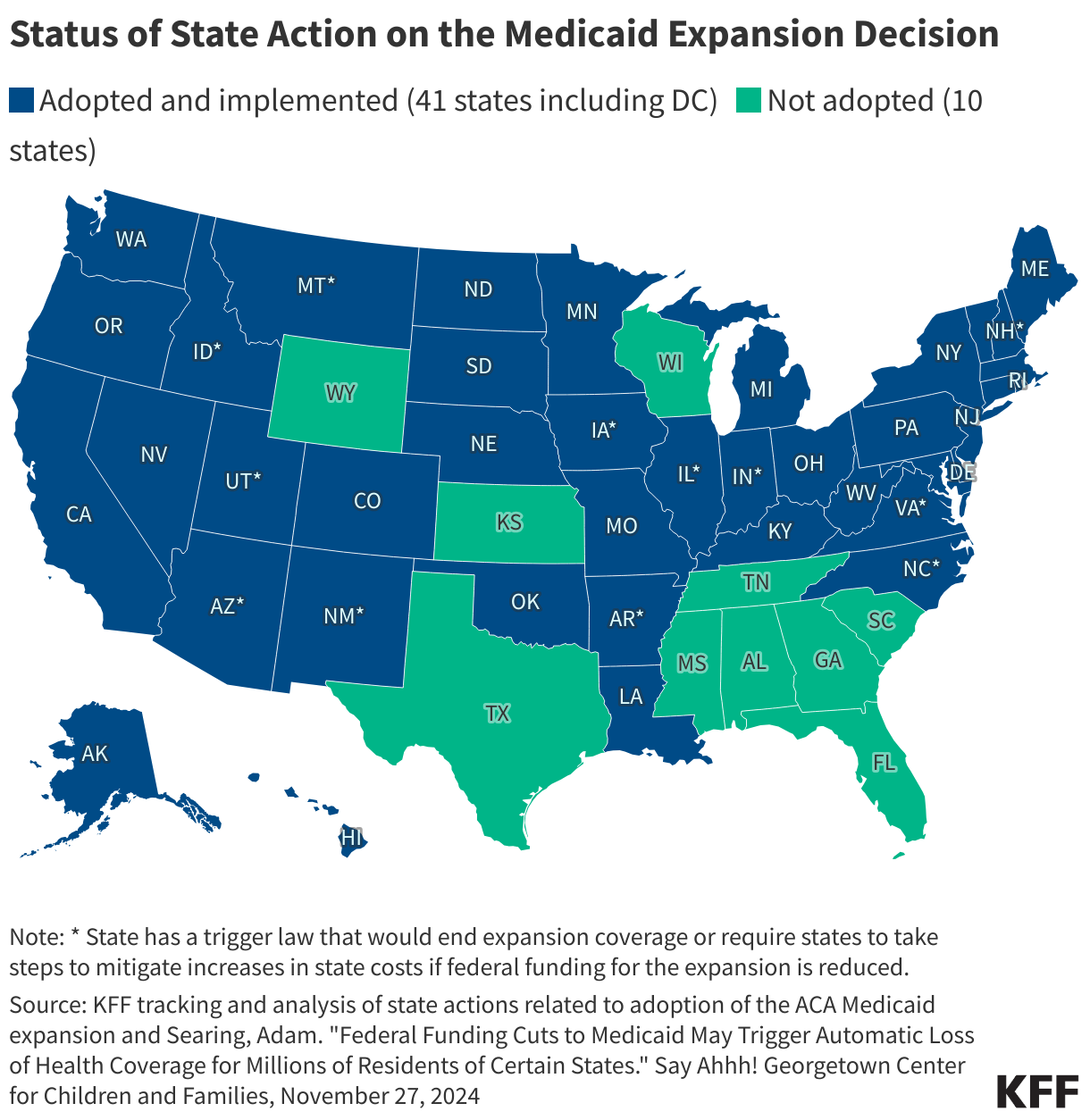

The cause of this difference has to do with the structure of OBBB’s healthcare-related provisions. Many of OBBB’s provisions target the 41 states that expanded Medicaid under the Affordable Care Act (ACA), and a quick comparison of KFF’s map showing ACA expansion states and KFF’s map showing OBBB cost allocation suggests that provisions targeting expansion states are a primary driver of the differential.

OBBB dictates several new provisions affecting the ACA expansion population. Work requirements for adults, increasing the frequency of eligibility redeterminations, and reducing provider taxes in expansion states are some of the policies that will be implemented. Notably, Georgia is not an expansion state. It also already has a work requirement in place for many adults thanks to its Georgia Pathways to Coverage Program.

Provisions that will impact Georgia are not directly related to dental spending, but they do pose a question about the present and future allocation of funds by policymakers. In addition to reducing provider taxes in expansion states, OBBB also creates a new moratorium on provider taxes. Provider taxes are used as a mechanism to generate revenue to cover a state’s share of Medicaid costs without drawing from general funds. Only one state, Minnesota, has an existing provider tax for dentists. Georgia currently levies provider taxes on nursing care facilities, hospitals, and ambulance services. As such, a cap on new provider taxes restricts Georgia lawmakers’ options for raising revenue in the future, but OBBB will not cut Georgia’s existing taxes.

The other provision with the potential to raise questions about the allocation of funds relates to state directed payments (SDP). States are generally prohibited from dictating how managed care organizations pay providers, but states may use SDPs to adopt minimum or maximum fee schedules, provide uniform payment increases for specified services, implement value-based purchasing models, or to participate in multi-payer or Medicaid specific delivery system reform. SDPs under OBBB will be capped at 110% of published Medicare rates for non-expansion states, or at a state’s published Fee-for-Service rate in the absence of said rates. Georgia is one of 11 states with an SDP raising at least one payment to commercial rates.

SDPs tend to be utilized to enhance payment for hospital based services, and Georgia is included in this trend. A study commissioned by the American Hospital Association estimates that Georgia’s rural hospitals will lose around $540 million over 10 years due to OBBB’s provisions, and it also estimates that around 17,000 rural Georgians will lose Medicaid coverage. The Georgia House Rural Development Council’s 2024 report indicated that the state has already seen 8 rural hospital closures in the last 10 years, and 8-10 more could be on there way. Loss of Medicaid funds could exacerbate an already precarious situation for hospitals on the precipice of closure. State policymakers are already working to maximize federal matching dollars before the cuts take effect.

OBBB, Dentists, and Georgia

The bill’s direct effects on Georgia dentists mostly arrives in the form of changes to the tax code, but the bill’s indirect effects will take time to unfold. OBBB will influence patients’ access to dental care, by both influencing state-level health policy and household income, and it may have additional downstream effects. Advocates seeking adequate reimbursement and coverage for dental care in Medicaid are concerned about how cuts will affect future resource allocation. Additional funding may be required to help stabilize rural hospitals and fill other gaps, but pent-up demand for dental care already exists in Georgia’s Medicaid system.

OBBB arrived at a time when Medicaid reimbursement has lagged behind inflation for over a decade. Georgia’s published fee-for-service reimbursement rates are already below 40% of average dentist charges and below 66% of average private dental insurance payment rates. Actual reimbursement is even lower, estimated to be closer to 35% of fair market value. For comparison, the average dental office needs 50% to 60% just to cover its overhead. In FY 2025, just over 750,000 Medicaid members used their dental benefits, less than half of the more than 1.9 million enrolled. Sooner or later, policymakers interested in addressing access to dental care will need to take this lag into account, but competing budgetary concerns may make it harder to do so.

In many ways, next year is no different from any other year. OBBB is neither the first nor the last major federal budget reconciliation bill, and the tides may shift again sooner than expected. As was mentioned above, Georgia’s Office of Planning and Budget is not terribly pessimistic about the near term. Some version of the status quo will most likely assert itself, representing neither a gain nor a loss for Georgia’s dentists and their patients. Within that paradigm, there is room to work, and planting seeds today means new potential opportunities will arise in time.

Shaping the Future of Dentistry in Georgia

Participating in advocacy designed to promote a bright future for dentistry remains the number 1 member benefit mentioned when dentists discuss the value of a GDA membership. Even the smallest bit of support or insight from GDA’s members can significantly advance the profession. To help contribute to ongoing advocacy, sign up as a contact dentist, give to GDAPAC, and attend events like district legislative receptions and LAW Day.